As you must be aware that Aircel has filed for bankruptcy in India, which means that the company which run AIRCEL mobile network in India do not have any more funds to run the network any more. This is also evident by the fact that most of the Aircel users are facing network blackouts since 27th Feb 2018.

So what will happen now?

Now there are few possibilities, one is, the NCLT will intervene and some other mobile network will take over aircel and the users will be given option to port or continue. Other possibility is aircel will send UPC to each and every users to port out.

But in any of the scenario, it may take few days to many days time, during which the users will not able to use their mobile numbers which is a difficult situation for many.

So the best solution for those who do not want to wait for the network to appear is PORT OUT of aircel manually to some other network.

Porting is easy. For that you need a Unique Porting Code (UPC) from aircel which can be used to port out to some other network. Normally UPC can be received by sending PORT to 1900.

But at many places there is either no network available or if network available outgoing calls and sms are not connection. In such situation, it is not possible to send the PORT OUT request via SMS.

If you are facing this situation, you can use the below method to get the UPC.

How To Port Out From Aircel ?

Things Needed To Port Out From Aircel :

- Aircel SIM Card (Mobile number and SIM card number)

- Any Working Mobile connection (Airtel/Idea/Vodafone etc., It does not work with JIO network)

How To Get Porting Code To Port Out From Aircel.

Its Essential to Get The Unique Porting Code To Submit Port in Request To Other Operator, If there is no network in your area, follow Below Method & You Will Get Port Code without Aircel Network

Its Essential to Get The Unique Porting Code To Submit Port in Request To Other Operator, If there is no network in your area, follow Below Method & You Will Get Port Code without Aircel Network

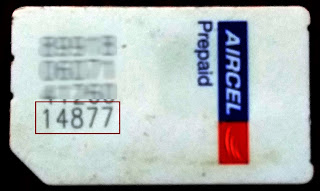

1. Take our your SIM card and note down the last 5 digits of the SIM number. (As shown in the Image.

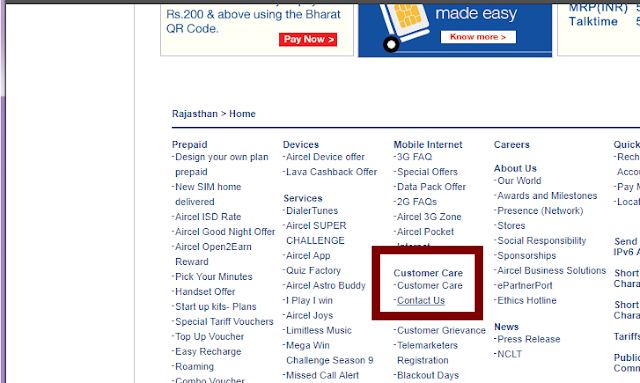

2. Now Call the AIRCEL Customer Care Number (for non aircel numbers) from Any Operator. To get the customer care number of your region visit AIRCEL Website and select your region. After that look at the bottom of web page and open Reach Us page. See the below image. I am also adding the customer care numbers below. If the CC number does not work for you, you can use the aircel website.

3. Now follow the instructions on IVR phone. Choose language then enter Your Aircel Number.

Watch this video for more information.

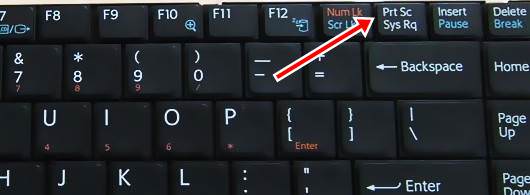

4. It Will Ask to Put last 5 digits of your sim number.

- Rajasthan : 9782012345

- Bihar & jharkhand : 9852012345

- Delhi : 9716012345

- Andhra Pradesh : 9700012345

- Assam : 9854012345

- Kolkatta : 9804012345

- Tamil naidu : 9750999209 /9551299210

- Chennai : 98410 12345

- Haryana : 9802012345

- Himachal Pradesh : 9857012345

- Karnataka : 9738012345

- Kerala : 9809012345

- Madhya Pradesh : 9806012345

- Maharashtra : 9762012345

- Mumbai : 9768012345

- Orrisa : 9856012345

- Punjab : 9803012345

- Uttar Pradesh : 9808012345

- West Bengal : 9851012345

3. Now follow the instructions on IVR phone. Choose language then enter Your Aircel Number.

Watch this video for more information.

4. It Will Ask to Put last 5 digits of your sim number.

5. Thats all!! You Will Get Unique Port Code (UPC) Without Aircel Network.

6. Now Follow Standard Porting Method to Port into Any Available Network.

If you face any problem, let us know in comment.

6. Now Follow Standard Porting Method to Port into Any Available Network.

If you face any problem, let us know in comment.